CJO International: Operations & Partner Engagements

CJO International works with strategic partners across Nigeria to expand access to affordable finance for small and medium-sized enterprises (SMEs). Through these collaborations, the company combines financial expertise, technological innovation, and market reach to deliver inclusive solutions that empower businesses and strengthen the economy.

![]()

1. Core Operations

-

E-Invoice Discounting Solution

CJO International facilitates early access to working capital for SMEs by enabling them to submit validated invoices from major corporate clients. Partner banks then purchase these invoices at discounted rates, providing SMEs with immediate liquidity. -

Tailored SME Financing Products

Beyond invoice discounting, CJO collaborates with financial institutions to provide short-term working capital loans and structured trade finance products designed to meet the unique needs of SMEs across different sectors. -

Financial Education & Advisory

The company organizes financial advisory programs and digital literacy workshops, equipping SMEs not only with access to capital but also the financial acumen to manage growth effectively. -

Inclusive Growth Strategy

By combining financing, education, and market linkages, CJO International strengthens supply chains, promotes financial inclusion, and fosters sustainable SME growth across Nigeria.

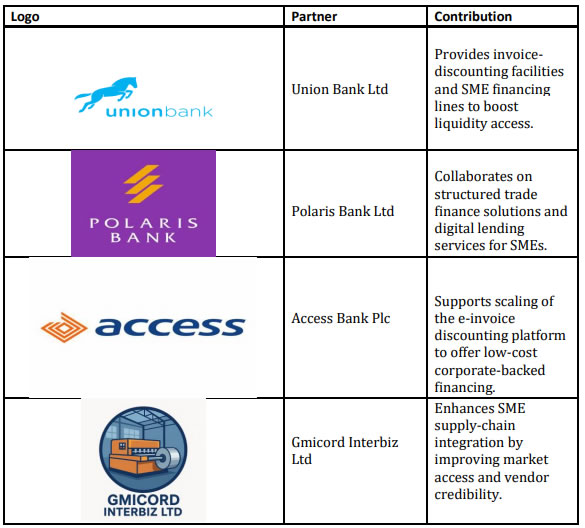

2. Strategic Partner Engagements

a. Banking Partners

-

Union Bank Ltd: Provides core funding through invoice-discounting facilities, enabling SMEs to collect payments early from corporate clients.

-

Polaris Bank Ltd: Co-develops structured trade finance and digital lending products specifically targeting SMEs.

-

Access Bank Plc: Assists with scaling the e-invoice discounting platform, ensuring broader access to affordable, corporate-backed finance.

b. Industrial & Corporate Collaborators

-

Gmicord Interbiz Ltd: Enhances SME supply-chain integration and vendor credibility through procurement and logistics expertise.

-

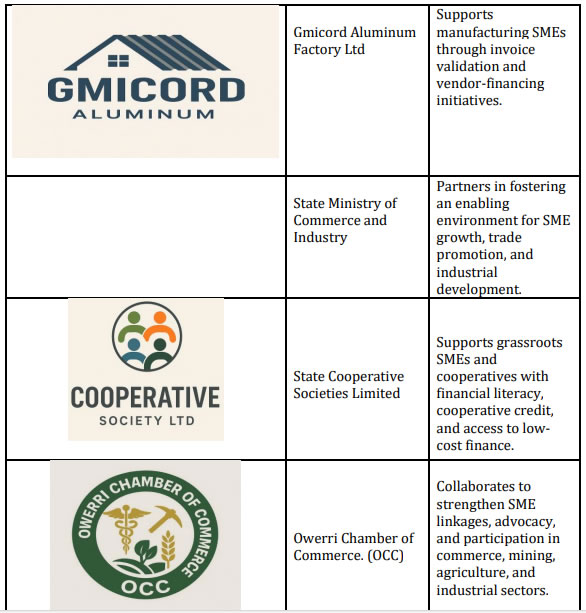

Gmicord Aluminum Factory Ltd: Supports manufacturing SMEs by validating supply-chain invoices and participating in vendor-financing programs.

c. Government & Institutional Allies

-

State Ministry of Commerce and Industry: Fosters enabling policies and industrial development for SME growth and trade.

-

State Cooperative Societies Limited: Promotes grassroots financial inclusion by empowering cooperative groups with access to credit, literacy training, and low-cost financing models.

-

Owerri Chamber of Commerce, Mines and Agriculture (OCCIMA): Advocates for SMEs, promotes market linkages, and drives cross-sector collaboration in commerce, agriculture, and mining.

3. Collaborative Framework & Impact

Through these partnerships, CJO International builds a multi-tiered support ecosystem for SMEs:

-

Technical & Financial Synergy: Banking partners provide capital and product channels; industry collaborators ensure market connectivity and validation; government and institutional allies drive policy, outreach, and capacity-building.

-

Risk Mitigation & Trust Building: Corporate-validated invoices reduce lender risk and boost financial confidence.

-

Scalability & Reach: Collaborations with cooperatives and chambers expand outreach to underserved urban and rural SME clusters.

-

Sustainability: Alignment with both public and private sectors embeds finance into existing economic and governance structures, ensuring resilience and long-term impact.

In Summary

CJO International stands at the intersection of innovation, collaboration, and inclusive finance. Through its operational model and partner ecosystem, the company delivers not only access to capital but also structural support for SMEs across the Nigerian economy—catalyzing growth, equity, and enterprise resilience.